Corruption and Iraq Banks Performance: Expanding the “Grease or Sand the Wheel” Hypothesis

DOI:

https://doi.org/10.21271/zjhs.28.3.18Keywords:

Corruption, ROAA, Grease the wheel hypothesis, Quantile regression, Banking industry.Abstract

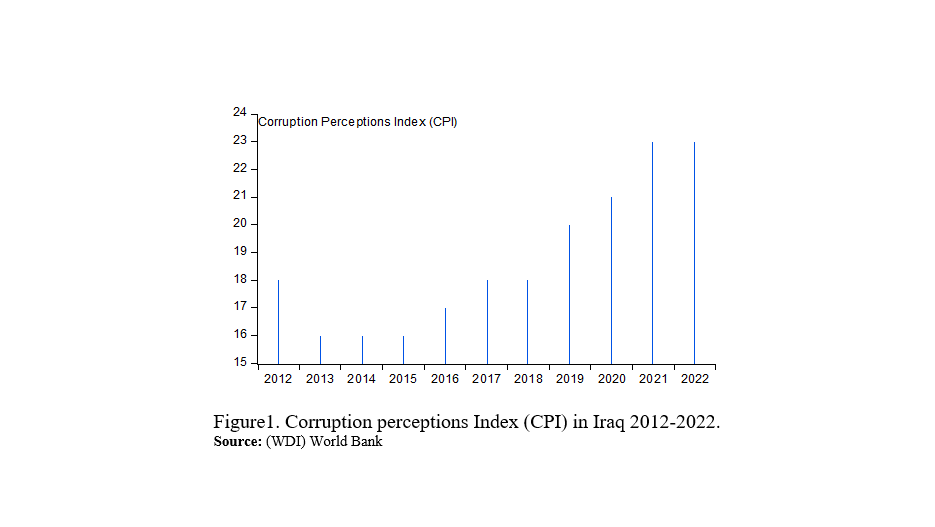

The main goal of the study is to investigate the effect of corruption on the profitability of Iraqi banks during the period 2012–2020. The paper used a sample of nine private banks that account for a considerable proportion of the overall assets of the Iraqi commercial banks. The advanced technique of method of moment quantile regression (MMQREG) is used. To validate the initial results, we use the feasible generalized least squares (FGLS) and panel-corrected standard errors (PCSEs) techniques. Our results support the ‘grease or sand the wheel’ hypothesis of corruption for Iraqi banks. This finding supports the view that the current weak governance structures and the power-sharing political system in the country serve as an ‘escape hatch’ for individuals in power. Furthermore, the findings of the PCSE and FGLS validated the MMQREG results in terms of coefficient sign. Correspondingly, income and inflation are shown to be positive drivers of ROAA. Furthermore, it was demonstrated that Iraqi banks are not getting any benefit from economies of scale regarding financial performance. On the other hand, our results reveal that the ratio of cost income has a statistically significant negative effect on bank profitability, implying that Iraqi private banks are operating below their optimal capacity.

References

- Abdullah, S.M., 2019. Corruption protection: Fractionalization and the corruption of anti-corruption efforts in Iraq after 2003. British Journal of Middle Eastern Studies, 46(3), pp.358-374.

- Aburime, T.U., 2009. Impact of corruption on bank profitability in Nigeria. Euro Economica, 23(02), pp.50-57.

- Abuzayed, B., Ammar, M.B., Molyneux, P. and Al-Fayoumi, N., 2024. Corruption, lending and bank performance. International Review of Economics & Finance, 89, pp.802-830.

- Adebayo, T.S., Akadiri, S.S., Akanni, E.O. and Sadiq-Bamgbopa, Y., 2022. Does political risk drive environmental degradation in BRICS countries? Evidence from method of moments quantile regression. Environmental Science and Pollution Research, 29(21), pp.32287-32297.

- Adewole, J.A., Dare, F.D. and Ogunyemi, J.K., 2019. Implications of financial intermediation on the performance of commercial banks in Nigeria: 2000-2017. Financial Markets, Institutions and Risks, 3(4).

- Al-Harbi, A., 2019. The determinants of conventional banks profitability in developing and underdeveloped OIC countries. Journal of Economics, Finance and Administrative Science, 24(47), pp.4-28.

- Al-Jafari, M.K. and Altaee, H.H.A., 2023. The Role of Labor Productivity in Reducing Carbon Emission Utilizing the Method of Moments Quantile Regression: Evidence from Top 40 Emitter Countries. International Journal of Economics and Finance, 15(3), p.1DOI.

- Al-Jafari, M.K., Altaee, H.H.A. and Adam, M.H.M., 2021. Bank-Specific, Government-Specific and Macroeconomic Determinants of Profitability: Evidence from the Banking Sector of Saudi Arabia. Indian Journal of Economics and Business, 20(2), pp.315-328.

- Altaee, H.H.A. and Azeez, S.J., 2023. Impacts of environment-related technology, structural change, and globalization on greenhouse gas emissions: evidence from top twenty emitter countries. International Journal of Energy Economics and Policy, 13(6), pp.690-697.

- Altaee, H.H.A., Talo, I.M.A. and Adam, M.H.M., 2013. Testing the financial stability of banks in GCC countries: Pre and post financial crisis. International Journal of Business and Social Research (IJBSR), 3(4), pp.93-105.

- Antwi, F., 2019. Capital adequacy, cost income ratio and performance of banks in Ghana. International Journal of Academic Research in Business and Social Sciences, 9(10), pp.168-184.

- Arshad, S. and Rizvi, S.A.R., 2013. Impact of corruption on bank profitability: an analysis of Islamic banks. International Journal of Business Governance and Ethics, 8(3), pp.195-209.

- Asteriou, D., Pilbeam, K. and Tomuleasa, I., 2016. The impact of economic freedom, business regulation and corruption on bank profitability and bank stability: evidence from Europe.

- Asteriou, D., Pilbeam, K. and Tomuleasa, I., 2021. The impact of corruption, economic freedom, regulation and transparency on bank profitability and bank stability: Evidence from the Eurozone area. Journal of Economic Behavior & Organization, 184, pp.150-177.

- Athari, S.A. and Bahreini, M., 2023. The impact of external governance and regulatory settings on the profitability of Islamic banks: Evidence from Arab markets. International Journal of Finance & Economics, 28(2), pp.2124-2147.

- Ayalew, Z.A., 2021. Capital structure and profitability: Panel data evidence of private banks in Ethiopia. Cogent Economics & Finance, 9(1), p.1953736.

- Bhandari, M.P., 2023. The Corruption a Chronic Disease of Humanity: Causes, Effects and Consequences. Scientific Journal of Bielsko-Biala School of Finance and Law, 27(1), pp.5-17.

- Bolarinwa, S.T. and Soetan, F., 2019. The effect of corruption on bank profitability. Journal of Financial Crime, 26(3), pp.753-773.

- Bougatef, K., 2017. Determinants of bank profitability in Tunisia: does corruption matter?. Journal of Money Laundering Control, 20(1), pp.70-78.

- Chalise, S., 2019. The Impact of Capital Adequacy and Cost-Income Ratio on Performance of Nepalese Commercial Banks. SSRG International Journal of Economics and Management Studies, 6(7), pp.78-83.

- Doğan, M. and Yildiz, F., 2023. Testing the Factors that Determine the Profitability of Banks with a Dynamic Approach: Evidence from Turkey. Journal of Central Banking Theory and Practice, 12(1), pp.225-248.

- Fhima, F., 2018, July. Corruption, banking stability and economic growth in the Mena region. In Proceedings of International Academic Conferences (No. 8209472). International Institute of Social and Economic Sciences.

- Hassan, M.K., Hasan, R., Miah, M.D. and Ashfaq, M., 2022. Corruption and bank efficiency: Expanding the ‘sand or grease the wheel hypothesis’ for the Gulf Cooperation Council. Journal of Public Affairs, 22, p.e2737.

- Hendeniya, H.G.G.M.N., Premarathna, W.G.I.D. and Tennekoon, S.T.M.S., 2023. The Effect of Corruption and Money Laundering on Banking Profitability and Stability of Licensed Commercial Banks in Sri Lanka.

- Jadah, H.M., Alghanimi, M.H.A., Al-Dahaan, N.S.H. and Al-Husainy, N.H.M., 2020. Internal and external determinants of Iraqi bank profitability. Banks and Bank Systems, 15(2), pp.79-93.

- Kumar, A., Ahmed, K., Bhayo, M.U.R. and Kalhoro, M.R., 2023. Banking performance and institutional quality: evidence from dynamic panel data analysis. International Journal of Finance & Economics, 28(4), pp.4717-4737.

- Maity, S. and Sahu, T.N., 2022. Financial Inclusion and the Role of Banking System. Palgrave Macmillan.

- Mongid, A. and Tahir, I.M., 2011. Impact of corruption on banking profitability in ASEAN countries: An empirical analysis. Impact of corruption on banking profitability in ASEAN countries: an empirical analysis, A Mongid, IM Tahir-Banks and Bank Systems, 6(1).

- Myint, U., 2000. Corruption: Causes, consequences and cures. Asia pacific development journal, 7(2), pp.33-58.

- Nasreen, S., Gulzar, M., Afzal, M. and Farooq, M.U., 2023. The Role of Corruption, Transparency, and Regulations on Asian Banks’ Performance: An Empirical Analysis. Journal of the Knowledge Economy, pp.1-32.

- Nguyen, T.X., 2023. Anti-corruption and bank performance: Evidence from a socialist-oriented economy. Plos one, 18(10), p.e0292556.

- Olarewaju, O.M., Olarewaju, O.O., Oladejo, T.M. and Migiro, S.O., 2017. Nexus of bank personnel and cost-income ratio (CIR) in Nigeria. Banks & bank systems, (12,№ 4 (cont.)), pp.154-162.

- Sufian, F. and Chong, R.R., 2008. DETERMINANTS OF BANK PROFITABILITY IN A DEVELOPING ECONOMY: EMPIRICAL EVIDENCE FROM THE PHILIPPINES. Asian Academy of Management Journal of Accounting & Finance, 4(2).

- Tharu, N.K. and Shrestha, Y.M., 2019. The influence of bank size on profitability: An application of statistics. International Journal of Financial, Accounting, and Management, 1(2), pp.81-89.

- Titiloye, T., 2020. Political Instability: A Major Detriment to Bank Stability in Nigeria-A Case Study Analysis (United Bank for Africa). Available at SSRN 3744380.

- World Bank Indicators (WDI) database at https://databank.worldbank.org.

- World Bank Worldwide Governance Indicators | DataBank (worldbank.org).

- Yekini, K., Adelopo, I. and Lloydking, R., 2019. Corruption and Bank Profitability: Understanding Sustainable Financial Inclusiveness in ECOWAS Region.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 Hatem Hatef Abdulkadhim Altaee, Munadhil Abduljabar Alsalim, Naz Hiwa Ghani

This work is licensed under a Creative Commons Attribution 4.0 International License.

Except where otherwise noted, content on this site is licenced

under a Creative Commons Attribution License 4.0 (CC BY- 4.0)